Highlights

- An advanced stage, 100% controlled copper project in Arizona

- Over 50,000m of historical drilling has been completed within the district, with near surface mineralization of copper, silver, zinc and gold

- Robust land package of over 9,600 acres (15 square miles) of mineral rights including over 1,800 acres of Patented mining claims and surface rights

- 3km trend of shallow mineralization and remains open in all directions

- Source of mineralization yet to be discovered

- Initial drill program currently underway

Ideally Located

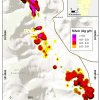

- The Corral Copper Project is located in Cochise County, Arizona, 15 miles east of the famous mining town of Tombstone and 22 miles north of the historical Bisbee mining camp which has produced more than 8 billion pounds of copper with grades of up to 23%. Production from the Bisbee mining camp is not necessarily indicative of the mineral potential at the Corral Copper Project.

- Corral Copper consists of 9,600 acres (15 square miles) of mineral rights including over 1,800 acres of Patented mining claims and surface rights.

Mining History

- The district has a mining history dating back to the late 1800s, with several small mines extracting copper from the area in the early 1900s, producing several thousand tons with grades up to 9.2% copper ore. Between 1950 and 2008, various companies explored parts of the district, but the effort was uncoordinated, non-synergistic and focused on discrete land positions and commodities due to the fragmented ownership. Intrepid has been able to secure data from various sources which provides a solid foundation in creating geological interpretations and identifying new target areas.

-

Over 50,000m of historical drilling has been completed within the district, with several significant near surface drill intercepts. Intrepid considers these historical drill results relevant, as the Company is using this data as a guide to plan current and future exploration programs.

Current Program

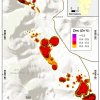

Intrepid is currently carrying out an initial 5,000 meter diamond drill program within a 3 kilometer trend, including the Holliday, Earp and Ringo zones. Drilling is focused on confirming historical results and extending some holes which ended in mineralization. The program commenced in February 2024 and is expted to take four months to complete. A total of 23 holes are planned within the 3 main zones of the Property.

Results from the first 12 holes confirm the 3-kilometer long trend of near survace carbonate replacement ("CRD") and related supergene enrichment oxide copper-gold-silver-zinc mineralization in the Holliday, Earp and Ringo zones. Highlights include:

- 193.15 meters (“m”) of 0.68% Copper (“Cu”) and 0.33 grams per ton (“gpt”) Gold (“Au”) (0.83% Copper Equivalent (“CuEq”)1) from 27.00 to 220.15m in Hole CC24_011 including,

- 105.20m of 1.17% Cu and 0.55 gpt Au (1.42% CuEq1)

- 48.85m of 2.24% Cu and 0.97 gpt Au (2.58% CuEq1) and

- 3.90m of 6.80% Cu and 1.02 gpt Au (6.54% CuEq1).

- 124.00m of 0.52% Cu and 0.35 gpt Au (0.73% CuEq1) from 10.00 to 134.00m in Hole CC24_001 including,

- 100.35m of 0.57% Cu and 0.41 gpt Au (0.81% CuEq1) and

- 4.00m of 2.70% Cu and 0.89 gpt Au (3.06% CuEq1).

- 159.65m of 0.57% Cu and 0.22 gpt Au (0.64% CuEq1) from 28.35 to 188.00m in Hole CC24_012 including,

- 40.45m of 0.97% Cu and 0.40 gpt Au (1.11% CuEq1) and

- 3.85m of 3.34% Cu and 1.54 gpt Au (3.86% CuEq1).

Highlights from the drill program to date, as well as all technical information, can be found below.

1 Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper, gold, silver and zinc assay values. All intervals reported are core lengths, and true thicknesses are yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated. Analyzed Grade corresponds composite weighted (“composites”) averages of laboratory. Metal Equivalent corresponds to undiluted metal equivalent of reported composites and Diluted Metal Equivalent takes into account dilution factors of 85% for Copper, and 80% for gold, silver and zinc for reported composites. Metal prices used for the CuEq and AuEQ calculations are in USD based on Ag $22.00/oz, Au $1900/oz, Cu $3.80/lb, Zn $1.15/lb The following equation was used to calculate copper equivalence: CuEq = Copper (%) (85% rec.) + (Gold (g/t) x 0.71)(80% rec.) + (Silver (g/t) x 0.0077)(80% rec.) + (Zinc (%) x 0.28)(80% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(80% rec.) + (Copper (%) x 1.4085)(85% rec.) + (Silver (g/t) x 0.0108)(80% rec.) + (Zinc (%) x 0.4188)(80% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

2024 Drill Results

The Holliday Zone

The Holliday Zone has a near surface mineralized footprint that is defined by historical drilling, favorable Abrigo Limestone (and Bolsa Formation), pre-mineral intrusions, alteration and copper-gold-silver-zinc replacement style mineralization and skarns (and secondary enrichment zones) that are locally high-grade. The Holliday Zone measures 860m (northwest to southeast) by 260m (southwest to northeast). To date, Intrepid has completed 7 holes in the Holiday Zone for a total of 1,148.59m. Highlight intercepts are included in Table 1 below.

Table 1: Highlight composite drill intercepts for the Holliday Zone1

|

DRILL HOLE DETAILS |

ANALYZED GRADE |

ANALYZED METAL EQUIVALENT |

DILUTED METAL EQUIVALENT |

||||||||

|

HOLE |

FROM |

TO |

LENGTH |

COPPER |

GOLD |

SILVER |

ZINC |

CUEQ |

AUEQ |

CUEQ |

AUEQ |

|

ID |

(m) |

(m) |

(m) |

(%) |

(ppm) |

(ppm) |

(%) |

(%) |

(g/t) |

(%) |

(g/t) |

|

CC24_001 |

10.00 |

134.00 |

124.00 |

0.52 |

0.35 |

7.58 |

0.12 |

0.88 |

1.20 |

0.73 |

1.00 |

|

Incl. |

10.00 |

110.35 |

100.35 |

0.57 |

0.41 |

7.33 |

0.13 |

0.98 |

1.34 |

0.81 |

1.11 |

|

Incl. |

75.00 |

79.00 |

4.00 |

2.70 |

0.89 |

33.80 |

0.07 |

3.66 |

5.02 |

3.06 |

4.20 |

|

CC24_002 |

5.45 |

18.65 |

13.20 |

0.54 |

0.02 |

4.01 |

0.13 |

0.62 |

0.86 |

0.53 |

0.72 |

|

CC24_003 |

26.00 |

114.65 |

88.65 |

0.22 |

0.09 |

4.44 |

0.14 |

0.37 |

0.51 |

0.31 |

0.42 |

|

Incl. |

26.00 |

66.00 |

40.00 |

0.40 |

0.09 |

4.51 |

0.11 |

0.53 |

0.73 |

0.45 |

0.61 |

|

CC24_004 |

3.45 |

65.00 |

61.55 |

0.28 |

0.10 |

3.42 |

0.22 |

0.45 |

0.61 |

0.37 |

0.51 |

|

Incl. |

16.70 |

46.30 |

29.60 |

0.44 |

0.15 |

3.84 |

0.05 |

0.59 |

0.81 |

0.49 |

0.68 |

|

And |

31.95 |

46.30 |

14.35 |

0.53 |

0.26 |

6.12 |

0.03 |

0.78 |

1.07 |

0.65 |

0.89 |

|

CC24_004 |

82.00 |

129.90 |

47.90 |

0.21 |

0.28 |

3.06 |

0.07 |

0.45 |

0.62 |

0.37 |

0.51 |

|

Incl. |

94.50 |

100.00 |

5.50 |

0.76 |

0.22 |

5.46 |

0.18 |

1.02 |

1.40 |

0.86 |

1.17 |

|

CC24_005 |

42.75 |

77.55 |

34.80 |

0.56 |

0.14 |

8.79 |

0.03 |

0.75 |

1.02 |

0.62 |

0.86 |

|

Incl. |

50.25 |

77.55 |

27.30 |

0.71 |

0.12 |

8.97 |

0.04 |

0.88 |

1.21 |

0.74 |

1.01 |

|

CC24_006 |

10.00 |

108.00 |

98.00 |

0.40 |

0.22 |

4.91 |

0.14 |

0.65 |

0.89 |

0.54 |

0.74 |

|

Incl. |

90.00 |

108.00 |

18.00 |

1.34 |

0.96 |

11.83 |

0.32 |

2.24 |

3.07 |

1.86 |

2.55 |

|

CC24_007 |

98.00 |

143.80 |

45.80 |

0.50 |

0.37 |

6.26 |

0.07 |

0.85 |

1.16 |

0.70 |

0.96 |

|

Incl. |

108.95 |

143.80 |

34.85 |

0.62 |

0.47 |

7.20 |

0.07 |

1.04 |

1.42 |

0.86 |

1.18 |

The Earp Zone

The Earp Zone is located 250m southeast of the Holliday Zone and has a near surface mineralized footprint that is defined by historical drilling, favorable Abrigo Limestone (and Bolsa Formation), pre-mineral intrusions, alteration and copper-gold-silver-zinc replacement style mineralization, skarn, and secondary enriched copper oxide zones that are locally high-grade. The Earp Zone measures approximately 1,000m (northwest to southeast) by 320m (southwest to northeast). To date, Intrepid has completed 3 holes in the Earp Zone for a total of 383.75m. Highlight intercepts are included in Table 2 below.

Table 2: Highlight composite drill intercepts for the Earp Zone1

|

DRILL HOLE DETAILS |

ANALYZED GRADE |

ANALYZED METAL EQUIVALENT |

DILUTED METAL EQUIVALENT |

||||||||

|

HOLE |

FROM |

TO |

LENGTH |

COPPER |

GOLD |

SILVER |

ZINC |

CUEQ |

AUEQ |

CUEQ |

AUEQ |

|

ID |

(m) |

(m) |

(m) |

(%) |

(ppm) |

(ppm) |

(%) |

(%) |

(g/t) |

(%) |

(g/t) |

|

CC24_008 |

36.00 |

66.00 |

30.00 |

0.31 |

0.05 |

0.47 |

0.07 |

0.38 |

0.52 |

0.32 |

0.43 |

|

Incl. |

37.30 |

42.00 |

4.70 |

1.08 |

0.09 |

0.73 |

0.08 |

1.17 |

1.61 |

0.99 |

1.36 |

|

CC24_008 |

124.20 |

182.00 |

57.80 |

0.21 |

0.01 |

0.49 |

0.01 |

0.22 |

0.31 |

0.19 |

0.26 |

|

Incl. |

132.00 |

152.00 |

20.00 |

0.33 |

0.02 |

0.74 |

0.02 |

0.35 |

0.49 |

0.30 |

0.41 |

|

CC24_009 |

3.75 |

32.50 |

28.75 |

0.41 |

0.04 |

1.94 |

0.07 |

0.48 |

0.65 |

0.40 |

0.55 |

|

CC24_010 |

10.00 |

112.00 |

102.00 |

0.28 |

0.08 |

2.13 |

0.55 |

0.52 |

0.72 |

0.43 |

0.60 |

|

and |

12.00 |

46.65 |

34.65 |

0.56 |

0.14 |

3.05 |

0.83 |

0.94 |

1.29 |

0.78 |

1.07 |

The Ringo Zone

The Ringo Zone is located approximately 350m southeast of the Earp Zone and has a shallow mineralized footprint that is defined by historical drilling, favorable Abrigo Limestone (and Bolsa Formation), pre-mineral intrusions, alteration and copper-gold-silver-zinc replacement style mineralization and secondary enriched copper oxide zones that are locally high-grade. The Ringo Zone measures approximately 900m (northwest to southeast) by 800m (southwest to northeast). To date, Intrepid has completed 8 holes in the Ringo Zone for a total of 1837.88m. Highlights from the first two holes are included in Table 3 below.

Table 3: Highlight composite drill intercepts for the Ringo Zone1

|

DRILL HOLE DETAILS |

ANALYZED GRADE |

ANALYZED METAL EQUIVALENT |

DILUTED METAL EQUIVALENT |

||||||||

|

HOLE |

FROM |

TO |

LENGTH |

COPPER |

GOLD |

SILVER |

ZINC |

CUEQ |

AUEQ |

CUEQ |

AUEQ |

|

ID |

(m) |

(m) |

(m) |

(%) |

(ppm) |

(ppm) |

(%) |

(%) |

(g/t) |

(%) |

(g/t) |

|

CC24_011 |

27.00 |

220.15 |

193.15 |

0.68 |

0.33 |

4.22 |

0.13 |

1.00 |

1.37 |

0.83 |

1.14 |

|

Incl. |

54.00 |

159.20 |

105.20 |

1.17 |

0.55 |

6.55 |

0.23 |

1.70 |

2.33 |

1.42 |

1.94 |

|

And |

115.75 |

164.60 |

48.85 |

2.24 |

0.97 |

11.39 |

0.15 |

3.09 |

4.23 |

2.58 |

3.54 |

|

And |

143.10 |

147.00 |

3.90 |

6.80 |

1.02 |

22.11 |

0.06 |

7.75 |

10.63 |

6.54 |

8.97 |

|

CC24_012 |

28.35 |

188.00 |

159.65 |

0.57 |

0.22 |

3.21 |

0.04 |

0.77 |

1.05 |

0.64 |

0.88 |

|

Incl. |

109.05 |

134.00 |

24.95 |

1.66 |

0.55 |

5.30 |

0.13 |

2.15 |

2.94 |

1.80 |

2.47 |

|

And |

115.00 |

124.30 |

9.30 |

3.15 |

0.68 |

9.53 |

0.11 |

3.76 |

5.16 |

3.17 |

4.34 |

|

Incl. |

142.00 |

182.45 |

40.45 |

0.97 |

0.40 |

6.99 |

0.01 |

1.32 |

1.81 |

1.11 |

1.52 |

|

Incl. |

171.00 |

174.85 |

3.85 |

3.34 |

1.54 |

18.19 |

0.01 |

4.61 |

6.33 |

3.86 |

5.29 |

1 Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper, gold, silver and zinc assay values. All intervals reported are core lengths, and true thicknesses are yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated. Analyzed Grade corresponds composite weighted (“composites”) averages of laboratory. Metal Equivalent corresponds to undiluted metal equivalent of reported composites and Diluted Metal Equivalent takes into account dilution factors of 85% for Copper, and 80% for gold, silver and zinc for reported composites. Metal prices used for the CuEq and AuEQ calculations are in USD based on Ag $22.00/oz, Au $1900/oz, Cu $3.80/lb, Zn $1.15/lb The following equation was used to calculate copper equivalence: CuEq = Copper (%) (85% rec.) + (Gold (g/t) x 0.71)(80% rec.) + (Silver (g/t) x 0.0077)(80% rec.) + (Zinc (%) x 0.28)(80% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(80% rec.) + (Copper (%) x 1.4085)(85% rec.) + (Silver (g/t) x 0.0108)(80% rec.) + (Zinc (%) x 0.4188)(80% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

Technical Information

All scientific and technical information on this webpage has been prepared by, or approved by Daniel MacNeil, PGeo. Mr. MacNeil is a Technical Advisor to the Company and is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Mr. MacNeil has verified the drilling data disclosed on this webpage, including the assay and test data underlying the information or opinions contained on this webpage. Mr. MacNeil verified the data disclosed (or underlying the information disclosed) by reviewing imported and sorted assay data; checking the performance of blank samples and certified reference materials; reviewing the variance in field duplicate results; and reviewing grade calculation formulas. Mr. MacNeil detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to on this webpage.

However, some of the data disclosed is related to historical drilling results which have been identified as such. Intrepid Metals and Mr. MacNeil have not undertaken any independent investigation of the sampling nor have they independently analyzed the results of the historical exploration work in order to verify the results. Intrepid and Mr. MacNeil considers these historical drill results relevant as the Company is using this data as a guide to plan exploration programs. The Company's current and future exploration work includes verification of the historical data through drilling.

Quality Assurance and Quality Control

Drill core was first reviewed by a geologist, who identified and marked intervals for sampling. The marked sample intervals were then cut in half with a diamond saw; half of the core was left in the core box and the other half was removed, placed in plastic bags, sealed and labeled. Intervals and unique sample numbers are recorded on the drill logs and the samples are sequenced with standards and blanks inserted according to a predefined QA/QC procedure. The samples are maintained under security on site until they are shipped to the analytical lab.

All core samples were sent to ALS Geochemistry (ALS), a division of ALS Global, in Tucson, Arizona, for sample preparation, with pulps sent to the ALS Geochemistry laboratory in Reno, Nevada for analysis. ALS meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015 for analytical procedures and is independent of the Company. HQ size core was split and sampled over approximately two metre intervals. Samples were analyzed using: ALS’s Fire Assay Fusion method (Au-AA23) with an AA finish for gold and by gravimetric finish (Au-GRA21) for samples assaying greater than 10 ppm (g/t) gold; by a 36-element four acid digest ICP-AES analysis (ME-ICP61) with additional analysis for Ore Grade Cu (Cu-OG62), Ore Grade Zn (Zn-OG62) and Ore Grade Pb (Pb-OG62); and for silver assays above 100 ppm (g/t) by Fire Assay Fusion method with gravimetric finish (Ag-GRA21). ME-ICP61 results were reported in parts per million (ppm), Ore Grade (OG62) results were reported in percent (%). In addition to ALS quality assurance- quality control (QA/QC) protocols, Intrepid implements an internal QA/QC program that includes the insertion of sample blanks, duplicates, and standards, with QA QC control samples comprising approximately 10% of the sample stream.