Intrepid Metals Intersects 42.5m of 0.96% Copper Starting 15m from Surface at Earp Zone at Corral Copper in Arizona

- 42.50 m of 0.96% Cu, 0.28 gpt Au and 5.10 gpt Ag (1.05% CuEq1) from 15.00m to 57.50m in Hole CC25_036 including

- 16.35m of 1.68% Cu, 0.67 gpt Au and 8.29 gpt Ag (1.90% CuEq1) and

- 1.30m of 11.05% Cu, 4.31 gpt Au and 30.60 gpt Ag (12.12% CuEq1).

- 44.55 m of 0.74% Cu, 0.20 gpt Au and 35.00 gpt Ag (1.04% CuEq1) from 3.10m to 47.65m in Hole CC25_033 including

- 21.60m of 1.47% Cu, 0.36 gpt Au and 64.65 gpt Ag (1.92% CuEq1).

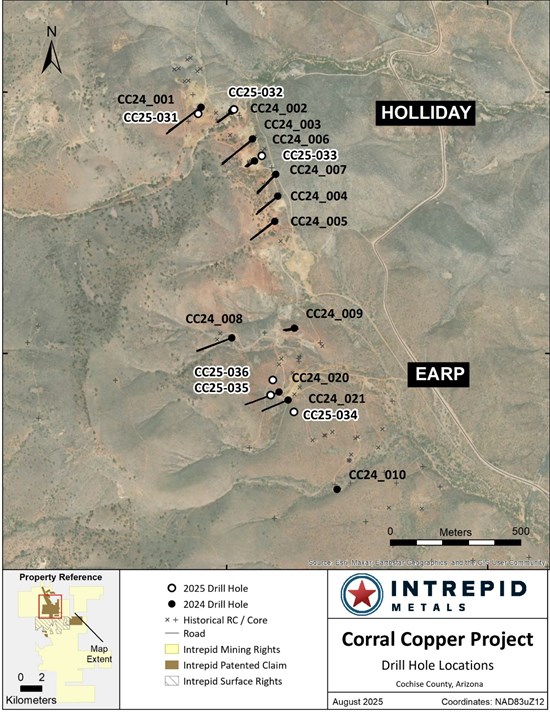

Vancouver, British Columbia--(Newsfile Corp. - August 19, 2025) - Intrepid Metals Corp. (TSXV: INTR) (OTCQB: IMTCF) ("Intrepid" or the "Company") is pleased to announce assay results from holes drilled at the Holliday and Earp Zones as part of the ongoing 2025 drill program at the Company's Corral Copper Property ("Corral" or the "Property") in Cochise County, Arizona. To date, eight holes have been drilled at Ringo, three at Holliday and three at Earp as part of the 2025 drill program for a combined total of fourteen holes totalling 3,696 meters ("m") (see Figure 1). The latest six holes continue to build on the encouraging mineralization identified in earlier drilling and further validate the potential of Corral as an emerging copper asset in a highly prospective district.

"The first drill results of 2025 from the Holliday and Earp zones continue to deliver strong outcomes, building on the momentum from last year," said Ken Engquist, CEO of Intrepid Metals. "Positioned northwest of Ringo, these results help define the true size of the corridor, filling in key gaps along the 3.5-kilometer trend and reinforcing our confidence in the scale and potential of this mineralized system."

Highlights from Holes CC25_031 to CC25_036:

CC25_036

- 42.50 m of 0.96% Copper ("Cu"), 0.28 grams per ton ("gpt") Gold ("Au") and 5.10 gpt Silver ("Ag") (1.05% Copper Equivalent ("CuEq")1) including.

- 16.35m of 1.68% Cu, 0.67 gpt Au and 8.29 gpt Ag (1.90% CuEq1) and

- 1.30m of 11.05% Cu, 4.31 gpt Au and 30.60 gpt Ag (12.12% CuEq1).

CC25_035

- 65.45 m of 0.25% Cu, 0.07 gpt Au and 2.39 gpt Ag (0.28% CuEq1) including.

- 18.95m of 0.46% Cu, 0.12 gpt Au and 2.96 gpt Ag (0.49% CuEq1).

CC25_033

- 44.55 m of 0.74% Cu, 0.20 gpt Au and 35.00 gpt Ag (1.04% CuEq1) including

- 21.60m of 1.47% Cu, 0.36 gpt Au and 64.65 gpt Ag (1.92% CuEq1).

CC25_032

- 97.80 m of 0.21% Cu, 0.26 gpt Au and 5.82 gpt Ag (0.42% CuEq1) including,

- 48.20m of 0.34% Cu, 0.32 gpt Au and 6.77 gpt Ag (0.59% CuEq1) and

- 3.35m of 1.26% Cu, 2.24 gpt Au and 14.43 gpt Ag (2.49% CuEq1).

Figure 1: Drill plan map from the Corral Copper Project

Table 1: Drill intercepts for the Holliday and Earp Zones1

| Drill Hole Details | Analyzed Grade | Diluted Metal Equivalent1 |

|||||||

| DRILL HOLE |

FROM (m) |

TO (m) |

LENGTH (m) |

COPPER (%) |

GOLD (ppm) |

SILVER (ppm) |

ZINC (%) |

CUEQ (%) |

AUEQ (ppm) |

| CC25_031 | 14.35 | 90.80 | 76.45 | 0.15 | 0.32 | 4.77 | 0.03 | 0.36 | 0.49 |

| Incl. | 28.30 | 54.15 | 25.85 | 0.26 | 0.33 | 7.70 | 0.03 | 0.47 | 0.65 |

| CC25_031 | 123.55 | 141.50 | 17.95 | 0.07 | 0.19 | 1.98 | 0.02 | 0.19 | 0.25 |

| CC25_031 | 160.25 | 205.75 | 45.50 | 0.27 | 0.10 | 4.89 | 0.03 | 0.33 | 0.45 |

| Incl. | 180.00 | 192.00 | 12.00 | 0.89 | 0.25 | 12.63 | 0.03 | 0.99 | 1.36 |

| CC25_031 | 265.00 | 275.50 | 10.50 | 0.11 | 0.05 | 2.47 | 0.02 | 0.15 | 0.20 |

| CC25_031 | 300.45 | 304.50 | 4.05 | 0.00 | 0.02 | 39.37 | 0.03 | 0.29 | 0.39 |

| CC25_032 | 5.20 | 103.00 | 97.80 | 0.21 | 0.26 | 5.82 | 0.18 | 0.42 | 0.57 |

| Incl. | 11.30 | 59.50 | 48.20 | 0.36 | 0.36 | 7.21 | 0.20 | 0.61 | 0.84 |

| And | 56.15 | 59.50 | 3.35 | 1.26 | 2.24 | 14.43 | 0.04 | 2.49 | 3.42 |

| CC25_032 | 114.90 | 154.05 | 39.15 | 0.01 | 0.06 | 3.06 | 0.22 | 0.12 | 0.16 |

| CC25_032 | 171.75 | 188.90 | 17.15 | 0.01 | 0.15 | 8.56 | 0.13 | 0.19 | 0.26 |

| CC25_032 | 199.95 | 220.30 | 20.35 | 0.03 | 0.26 | 8.50 | 0.26 | 0.30 | 0.41 |

| Incl. | 208.35 | 215.15 | 6.80 | 0.06 | 0.53 | 19.31 | 0.63 | 0.65 | 0.89 |

| And | 212.65 | 213.85 | 1.20 | 0.14 | 1.29 | 27.20 | 0.44 | 1.16 | 1.59 |

| CC25_033 | 3.10 | 47.65 | 44.55 | 0.74 | 0.20 | 35.00 | 0.23 | 1.04 | 1.43 |

| Incl. | 3.10 | 24.70 | 21.60 | 1.47 | 0.36 | 64.65 | 0.09 | 1.92 | 2.63 |

| Incl. | 29.15 | 32.50 | 3.35 | 0.11 | 0.04 | 6.87 | 0.93 | 0.39 | 0.53 |

| CC25_033 | 61.20 | 71.00 | 9.80 | 0.02 | 0.05 | 5.71 | 0.24 | 0.14 | 0.20 |

| CC25_033 | 153.00 | 164.70 | 11.70 | 0.49 | 0.42 | 18.42 | 0.03 | 0.79 | 1.09 |

| Incl. | 158.10 | 164.70 | 6.60 | 0.83 | 0.61 | 29.91 | 0.03 | 1.27 | 1.75 |

| CC25_033 | 206.00 | 228.75 | 22.75 | 0.01 | 0.20 | 5.17 | 0.11 | 0.18 | 0.25 |

| CC25_034 | 0.00 | 22.50 | 22.50 | 0.06 | 0.03 | 0.69 | 0.08 | 0.10 | 0.13 |

| CC25_034 | 69.00 | 95.50 | 26.50 | 0.10 | 0.02 | 0.72 | 0.07 | 0.12 | 0.17 |

| CC25_035 | 18.55 | 84.00 | 65.45 | 0.25 | 0.07 | 2.39 | 0.03 | 0.28 | 0.38 |

| Incl. | 18.55 | 37.50 | 18.95 | 0.46 | 0.12 | 2.96 | 0.04 | 0.49 | 0.67 |

| And | 18.55 | 28.35 | 9.80 | 0.73 | 0.21 | 4.74 | 0.06 | 0.79 | 1.08 |

| Incl. | 58.55 | 71.20 | 12.65 | 0.48 | 0.10 | 3.64 | 0.06 | 0.51 | 0.70 |

| And | 58.55 | 60.55 | 2.00 | 1.90 | 0.06 | 5.80 | 0.00 | 1.69 | 2.32 |

| CC25_035 | 116.00 | 123.50 | 7.50 | 0.11 | 0.09 | 0.66 | 0.05 | 0.17 | 0.23 |

| Incl. | 116.00 | 117.50 | 1.50 | 0.30 | 0.34 | 1.20 | 0.08 | 0.48 | 0.66 |

| CC25_036 | 15.00 | 57.50 | 42.50 | 0.96 | 0.28 | 5.10 | 0.16 | 1.05 | 1.44 |

| Incl. | 15.00 | 23.60 | 8.60 | 0.88 | 0.01 | 3.47 | 0.41 | 0.88 | 1.21 |

| Incl. | 27.40 | 35.00 | 7.60 | 0.43 | 0.08 | 5.64 | 0.20 | 0.50 | 0.68 |

| Incl. | 35.90 | 52.25 | 16.35 | 1.68 | 0.67 | 8.29 | 0.08 | 1.90 | 2.60 |

| And | 41.00 | 42.30 | 1.30 | 11.05 | 4.31 | 30.60 | 0.03 | 12.12 | 16.62 |

| CC25_036 | 66.20 | 73.50 | 7.30 | 0.08 | 0.03 | 0.71 | 0.12 | 0.12 | 0.16 |

| CC25_036 | 78.55 | 130.05 | 51.50 | 0.12 | 0.03 | 0.38 | 0.06 | 0.14 | 0.20 |

| CC25_036 | 149.75 | 154.50 | 4.75 | 0.16 | 0.03 | 1.32 | 0.02 | 0.17 | 0.23 |

| CC25_036 | 161.10 | 169.05 | 7.95 | 0.08 | 0.02 | 0.52 | 0.02 | 0.08 | 0.12 |

| CC25_036 | 198.35 | 199.05 | 0.70 | 0.82 | 0.04 | 1.60 | 0.00 | 0.73 | 1.00 |

Economic Geology of Corral

Precious and base metal mineralization at Corral is concentrated in structurally controlled northeast dipping siliciclastic and carbonate sedimentary rocks including (oldest to youngest) Cambrian Bolsa Quartzite, upper-Cambrian Abrigo Limestone, Devonian Martín limestone and Mississippian Escabrosa limestone as well as in Jurassic intrusions. The most intense mineralization occurs in the Abrigo and Escabrosa limestones (main host rocks) and locally in the Bolsa Quartzite. These host rocks are intruded by Jurassic mineralized intrusions including the Star Hill, Copper Bell and Sniveler porphyries, quartz latite sills, in addition to discordant porphyry-style mineralized breccia bodies.

The Corral Copper Property includes the Holliday, Earp and Ringo Zones (northwest to southeast), which are related domains of discontinuously outcropping, locally high grade CRD, skarn and distal porphyry style mineralization and associated supergene enrichment. The mineralization framework is interpreted as a distal porphyry copper geological environment. Recent geological mapping, sampling, prospecting and new drill hole data indicate that the Holliday, Earp and Ringo CRD/skarn zones are spatially separate expressions of magmatic-hydrothermal systems which each have root porphyry mineralization potential. A significant component of Intrepid's discovery strategy at Corral is to use alteration and mineralization zonation and the recent recognition of the structural framework to vector toward one or more mineralized porphyry copper centers (see News Release dated April 15, 2025).

Technical Information

All scientific and technical information in this news release has been prepared by, or approved by Daniel MacNeil, P.Geo. Mr. MacNeil is a Technical Advisor to the Company and is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Mr. MacNeil has verified the drilling data disclosed in this news release, including the assay and test data underlying the information or opinions contained in this news release. Mr. MacNeil verified the data disclosed (or underlying the information disclosed) in this news release by reviewing imported and sorted assay data; checking the performance of blank samples and certified reference materials; reviewing the variance in field duplicate results; and reviewing grade calculation formulas. Mr. MacNeil detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to in this release.

Table 2: Drill Hole Location Information for Holes CC25-026 through CC25_040

| DRILL | START | END | EASTING | NORTHING | ELEVATION | AZIMUTH | INCLINATION | DEPTH |

| HOLE | DATE | DATE | (m) | (m) | (m) | (°) | (°) | (m) |

| CC25_026 | 2025-04-28 | 2025-05-03 | 613245 | 3514003 | 1424 | 0 | -90 | 234.4 |

| CC25_027 | 2025-05-04 | 2025-05-08 | 613265 | 3514017 | 1423 | 0 | -90 | 224.65 |

| CC25_028 | 2025-05-09 | 2025-05-16 | 613267 | 3513936 | 1420 | 0 | -90 | 240.8 |

| CC25_029 | 2025-05-17 | 2025-05-23 | 613353 | 3513985 | 1415 | 225 | -60 | 305.1 |

| CC25_030 | 2025-05-24 | 2025-05-30 | 613219 | 3513900 | 1423 | 0 | -90 | 270.7 |

| CC25_031 | 2025-05-31 | 2025-06-06 | 611891 | 3515918 | 1501 | 235 | -40 | 320.65 |

| CC25_032 | 2025-06-07 | 2025-06-12 | 612028 | 3515934 | 1472 | 0 | -90 | 313.05 |

| CC25_033 | 2025-06-12 | 2025-06-17 | 612135 | 3515757 | 1485 | 235 | -80 | 230.1 |

| CC25_034 | 2025-06-18 | 2025-06-22 | 612169 | 3514840 | 1495 | 250 | -45 | 204.2 |

| CC25_035 | 2025-06-22 | 2025-06-29 | 612258 | 3514776 | 1494 | 245 | -50 | 249.95 |

| CC25_036 | 2025-06-30 | 2025-07-06 | 612177 | 3514898 | 1497 | 250 | -50 | 219.6 |

| CC25_037 | 2025-07-07 | 2025-07-18 | 613050 | 3514029 | 1435 | 0 | -90 | 320.00 |

| CC25_038 | 2025-07-19 | 2025-07-29 | 613337 | 3513870 | 1422 | 0 | -90 | 282.55 |

| CC25_039 | 2025-07-30 | 2025-08-09 | 613276 | 3513906 | 1420 | 0 | -90 | 255.75 |

| CC25_040* | 2025-08- | 613341 | 3513664 | 1438 | 0 | -90 |

*Hole in progress at time of news release

Quality Assurance and Quality Control

Drill core was first reviewed by a geologist, who identified and marked intervals for sampling. The marked sample intervals were then cut in half with a diamond saw; half of the core was left in the core box and the other half was removed, placed in plastic bags, sealed and labeled. Intervals and unique sample numbers are recorded on the drill logs and the samples are sequenced with standards and blanks inserted according to a predefined QA/QC procedure. The samples are maintained under security on site until they are shipped to the analytical lab.

All core samples were sent to ALS Geochemistry (ALS), a division of ALS Global, in Tucson, Arizona, for sample preparation, with pulps sent to the ALS Geochemistry laboratory in Reno, Nevada for analysis. ALS meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015 for analytical procedures and is independent of the Company. HQ size core was split and sampled over approximately two metre intervals. Samples were analyzed using: ALS's Fire Assay Fusion method (Au-AA23) with an AA finish for gold and by gravimetric finish (Au-GRA21) for samples assaying greater than 10 ppm (gpt) gold; by a 36-element four acid digest ICP-AES analysis (ME-ICP61) with additional analysis for Ore Grade Cu (Cu-OG62), Ore Grade Zn (Zn-OG62) and Ore Grade Pb (Pb-OG62); and for silver assays above 100 ppm (g/t) by Fire Assay Fusion method with gravimetric finish (Ag-GRA21). ME-ICP61 results were reported in parts per million (ppm), Ore Grade (OG62) results were reported in percent (%). In addition to ALS quality assurance-quality control (QA/QC) protocols, Intrepid implements an internal QA/QC program that includes the insertion of sample blanks, duplicates, and standards, with QA QC control samples comprising approximately 10% of the sample stream.

About Corral Copper

The Corral Copper Property, located near historical mining areas, is an advanced exploration and development opportunity in Cochise County, Arizona. Corral is located 15 miles east of the famous mining town of Tombstone and 22 miles north of the historic Bisbee mining camp which has produced more than 8 billion pounds of copper3. Production from the Bisbee mining camp, or within the district as disclosed in the next paragraph, is not necessarily indicative of the mineral potential at Corral.

The district has a mining history dating back to the late 1800s, with several small mines extracting copper from the area in the early 1900s, producing several thousand tons. Between 1950 and 2008, various companies explored parts of the district, but the effort was uncoordinated, non-synergistic and focused on discrete land positions and commodities due to the fragmented ownership. There is over 50,000m of historical drilling at Corral mainly centered on the Ringo, Earp and Holliday Zones and although this core has been destroyed, Intrepid has a historical digital drill hole archive database which the Company uses for the purposes of exploration targeting and drill hole planning. Intrepid, through ongoing exploration drilling and surface geological mapping, sampling and prospecting is increasing confidence in the validity of these data.

The Corral Copper Property is comprised of the Excelsior Property, the CCCI Properties, the Sara Claim Group and the MAN Property. The Company has completed the acquisition of the Excelsior Property and Sara Claim Group through purchase and sale agreements. The Company has the right to acquire the corporate group that holds the CCCI Properties through an option agreement. The Company has the right to acquire the MAN Property through an option agreement. See the "Commitments" section of the Company's most recently filed Management Discussion and Analysis for further details.

Intrepid is confident that by combining modern exploration techniques with historical data and with a clear focus on responsible development, the Corral Copper Property can quickly become an advanced exploration stage project and move towards development studies.

About Intrepid Metals Corp.

Intrepid Metals Corp. is a Canadian company focused on exploring for high-grade essential metals such as copper, silver, and zinc mineral projects in proximity to established mining jurisdictions in southeastern Arizona, USA. The Company has acquired or has agreements to acquire several drill ready projects, including the Corral Copper Project (a district scale advanced exploration and development opportunity with significant shallow historical drill results), the Tombstone South Project (within the historical Tombstone mining district with geological similarities to the Taylor Deposit, which was purchased for $1.3B in 20184, though mineralization at the Taylor Deposit is not necessarily indicative of the mineral potential at the Tombstone South Project) both of which are located in Cochise County, Arizona and the Mesa Well Project (located in the Laramide Copper Porphyry Belt in Arizona). Intrepid has assembled an exceptional team with considerable experience with exploration, developing, and permitting new projects within North America. Intrepid is traded on the TSX Venture Exchange (TSXV) under the symbol "INTR" and on the OTCQB Venture Market under the symbol "IMTCF". For more information, visit www.intrepidmetals.com.

INTREPID METALS CORP.

On behalf of the Company

"Ken Engquist"

CEO

For further information regarding this news release, please contact:

Ken Engquist, CEO

604-681-8030

Notes

1 Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper, gold, silver and zinc assay values according to a 0.10% CuEq cutoff (see below) and include a maximum of 10 meters of internal dilution. All intervals reported are down hole core lengths, and true thicknesses have yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated. Analyzed Grade corresponds composite weighted ("composites") averages of laboratory analyses. Metal Equivalent assumes estimated recovery factors including 85% recovery for copper, and 80% recovery for gold, silver and zinc for reported composite intervals. Metal prices used for the CuEq and AuEq calculations are in USD based on Ag $22.00/oz, Au $1900/oz, Cu $3.80/lb, Zn $1.15/lb The following equation was used to calculate copper equivalence: CuEq = Copper (%) (85% rec.) + (Gold (g/t) x 0.71)(80% rec.) + (Silver (g/t) x 0.0077)(80% rec.) + (Zinc (%) x 0.28)(80% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (gpt)(80% rec.) + (Copper (%) x 1.4085)(85% rec.) + (Silver (gpt) x 0.0108)(80% rec.) + (Zinc (%) x 0.4188)(80% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries.

2 Data disclosed in this news release includes historical drilling results and information derived from historic drill results, Intrepid Metals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work to verify the results. Intrepid considers these historical data relevant as the Company is using this data as a guide to plan exploration programs. The Company's current and future exploration work includes verification of the historical data through diamond drilling.

3 Information disclosed in this news release regarding the historic Bisbee Camp can be found on the Copper Queen Mine website and on the City of Bisbee website (www.bisbeeaz.gov/2174/Bisbee-History).

4 Details regarding the sale of the Taylor Deposit can be found in South32 News Release dated October 8, 2018 (South32 completes acquisition of Arizona Mining).

Cautionary Note Regarding Forward-Looking Information

Certain statements contained in this release constitute forward-looking information within the meaning of applicable Canadian securities laws. Such forward-looking statements relate to: the potential of the property; the interpretation of drills results; potential of Corral as an emerging copper asset in a highly prospective district; the potential of the mineralized system; the potential for porphyry mineralization; the completion of additional drillholes; the exploration potential of the Corral Copper Property and the Company's other mineral projects; and potential future production.

In certain cases, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the Company can raise additional financing to continue operations; the results of exploration activities, commodity prices, the timing and amount of future exploration and development expenditures, the availability of labour and materials, receipt of and compliance with necessary regulatory approvals and permits, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to the ability to access infrastructure, risks relating to the failure to access financing, risks relating to changes in commodity prices, risk related to unanticipated geological or structural formations and characteristics risks related to current global financial conditions, risks related to current global financial conditions and the impact of any future global pandemic on the Company's business, reliance on key personnel, operational risks inherent in the conduct of exploration and development activities, including the risk of accidents, labour disputes and cave-ins, regulatory risks including the risk that permits may not be obtained in a timely fashion or at all, financing, capitalization and liquidity risks, risks related to disputes concerning property titles and interests, environmental risks and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this news release. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262928